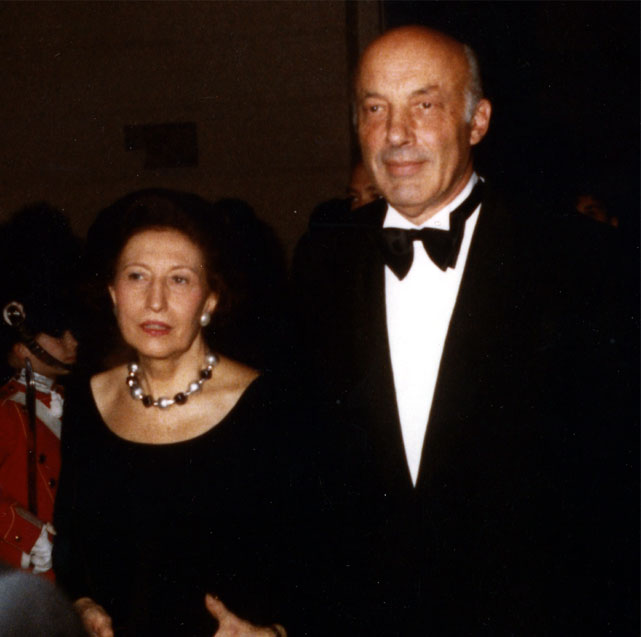

Jean Guyot, Founding President of the Hippocrene Foundation,Jean Guyot passed away on 9 September 2006 in Paris, at the age of 85. His life and career were marked by a strong and unfailing commitment to Europe.

After World War II, during which he fought as part of the French Resistance, Jean Guyot became Inspector of Finance and joined the cabinet of Robert Schuman in 1946. Later he entered the Department of Treasury where, as Deputy Director, he assumed responsibility for State cash management and investment financing. He participated in the Investment Commission, set up on the initiative of François Bloch-Lainé. He also helped allocate counterpart funds from the Marshall Plan in France, deeming them perfect for financing the investments of the Monnet Plan. Indeed, Jean Guyot often worked with the Monnet Plan, led by Jean Monnet, with whom he developed ties of mutual respect and trust.

When the European Coal and Steel Community (ECSC) was formed, Jean Monnet asked Jean Guyot to become its first financial director. He agreed and helped lend the first European institution credibility among European and American financial circles by enabling the High Authority of the ECSC to issue loans in its own name, which at the time meant little, particularly in the eyes of American investors. These operations were carried out by a handful of financiers, including André Meyer, a partner of Lazard, David Rockefeller, chairman of Chase Manhattan Bank, and Siegmund Warburg.